38+ Loan calculator with cost of borrowing

The Loan Estimate and Closing Disclosure are now used by lenders to estimate and convey the cost of borrowing outlining customary fees. States borrowing cost fell for the second consecutive week on Monday with the weighted average cut-off easing by 4 bps to 767 per cent from 771 per cent in the last auction when it slid by 7 bps.

Loan Payment Formula Loan Credit Agencies Credit Worthiness

A shorter period such as 15 or 20 years typically includes a lower interest rate.

. The mortgage should be fully paid off by the end of the full mortgage term. Calculate mortgage expenses such as home loan applications monthly repayments property management and more. Upfront MIP payment is 175 of the loan amount The annual MIP cost is 045-105 of the loan amount MIP is paid throughout the entire loan.

At the end of the mortgage term the original loan will still need to be paid back. We chose BuildBuyRefi as our best overall construction loan lender because it lends in 47 states offers loans with low down payments and low interest rates and can finance the land the construction and a permanent. The company has over 100 years of combined experience.

By tweaking the loan amount loan term and interest rate you can get a sense of the possible overall costYou will see that as. A Practical Example Highlighting Common Closing Costs. A personal loan are a type of unsecured loan usually between 1000 and 25000.

Commercial cash-out refinance loans. You can also try testing our Borrowing Power Calculator to have an idea of how much you can afford to borrow. The 2021 deferral limit for 401k plans was 19500 the 2022 limit is 20500.

Interest ratethe percentage of the loan charged as a cost of borrowing. Mortgages can charge either fixed-rate mortgages. Discover how much you could borrow and what it could cost with our easy-to-use mortgage calculator from Principality Building Society.

3 minimum requirement for a 97-3 loan. As you can see the difference between the cost of borrowing the loan with a 763 and 1188 APR is significant. Lets look at some VA loan co-borrowing scenarios and how they might play out in your VA loan process.

When borrowing from an SMSF in Australia trustees must organise an LBRA. This calculator allows you to select your loan type conventional FHA or VA or if you will pay cash for the property. Comparison Rate 653 pa.

The VA loan is the only program that lets you access 100 of your equity in a cash-out refinance a key difference from standard refinancing requirements. Early on in the loans term a relatively large share of the payment is applied toward interest then as the borrower pays down the loan an increasing share of. Compare rates from lenders to get the best deal.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. The program includes down payment and closing cost assistance of up to 5 of the mortgage amount as a no-interest no-monthly-payment second lien. However with the VA loan the only co-signers allowed are your legally married spouse or an unmarried military member.

A lot of mortgages contain upfront fees that help cover administrative expenses and the cost of offering lower rates. Additionally your total DTI can be no higher than 45. VA-Eligible Borrowers and Unmarried Partners.

Youd save 35839 in interest over the life of your loan by opting for the 763 rate over the 1188 rate and your monthly payment would be about 10 cheaper. Car buyers can use these quotes to estimate competitive loan rates before dealing with an auto dealership in a negotation where the dealer has the upper hand and charges too high of an interest rate or tries to require unneeded extended warrany programs as. Principal paid and your loan balance over the life of your loan.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. We publish current Redmond auto loan rates for new used vehicles. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

PMI is 05-1 of the loan amount per year PMI is canceled once your mortgage balance reaches 78 Average closing cost is between 2-5 of the loan. The yield on the benchmark 10-year G-secs also declined in the week by 4 bps to 723 per cent from 727 per cent last Tuesday Icra Ratings said. With a fixed rate loan the amount of each payment stays the same across the duration of the loan but the percent of each payment that goes toward principal or interest changes over time.

Use an auto loan calculator to determine a comfortable. Most fixed-rate mortgages are for 15 20 or 30-year terms. Use this calculator to test out any loan that you are considering.

Common VA Loan Co-Borrowing Scenarios. Current Redmond Auto Loan Rates. BuildBuyRefi formerly Nationwide Home Loans Group is a division of Magnolia Bank.

A cash-out refinance commercial loan allows you to replace your existing mortgage with a new one by borrowing more money than you currently owe on the. If your score is at least 580 but less than 620 your mortgage payment cant account for more than 38 of your gross monthly income. Conventional commercial loans are geared toward more established business owners who can meet the more stringent borrowing requirements.

Find news and advice on personal auto and student loans. Both of you will have a hard time qualifying for borrowing opportunities in the. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

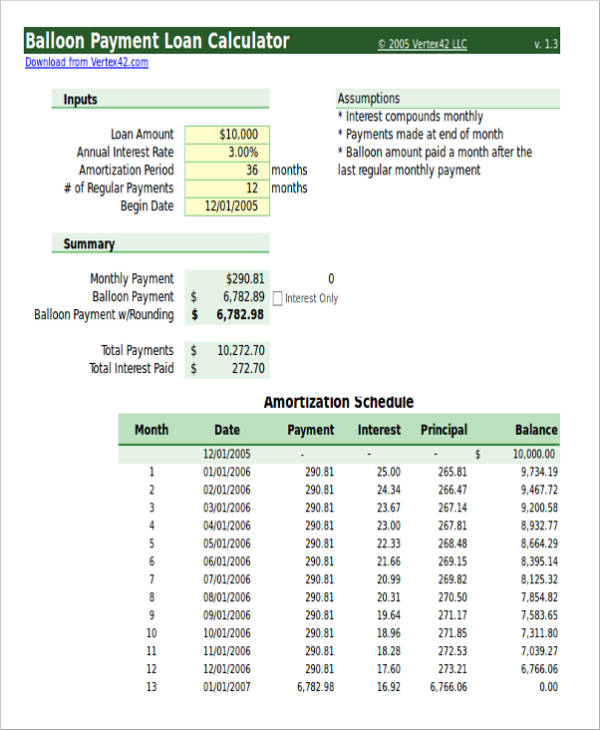

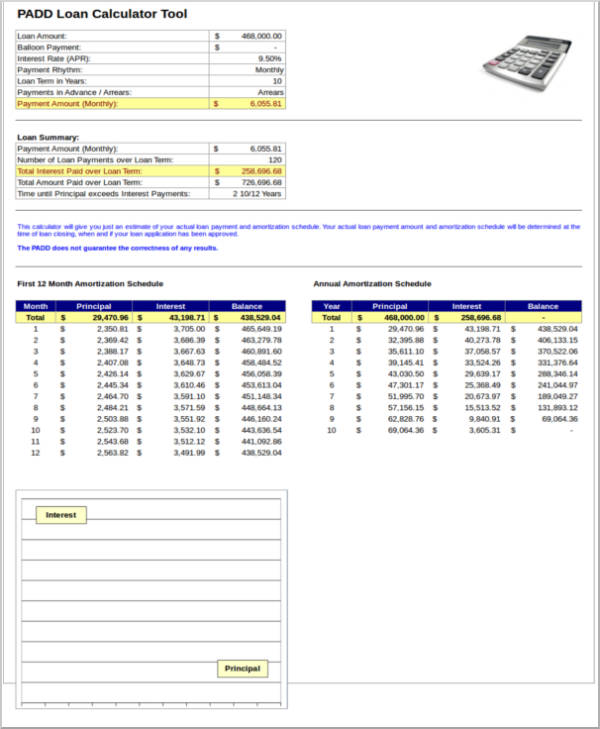

Why do you need an LBRA for an SMSF loan. Our amortization schedule calculator will show your payment breakdown of interest vs. The repayment term can be from 1 to 7 years.

Total interest including fees 262487. The IRS contribution limit increases along with the general cost-of-living increase due to inflation. Loan termthe amount of time over which the loan must be repaid in full.

See how your loan balance decreases. The Westpac home loan early termination fee or break cost is applicable if you have a fixed rate home loan and repay part of or the whole. With an interest only mortgage you are not actually paying off any of the loan.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. With a capital and interest option you pay off the loan as well as the interest on it. The repayment term can be from 1 to 7 years.

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

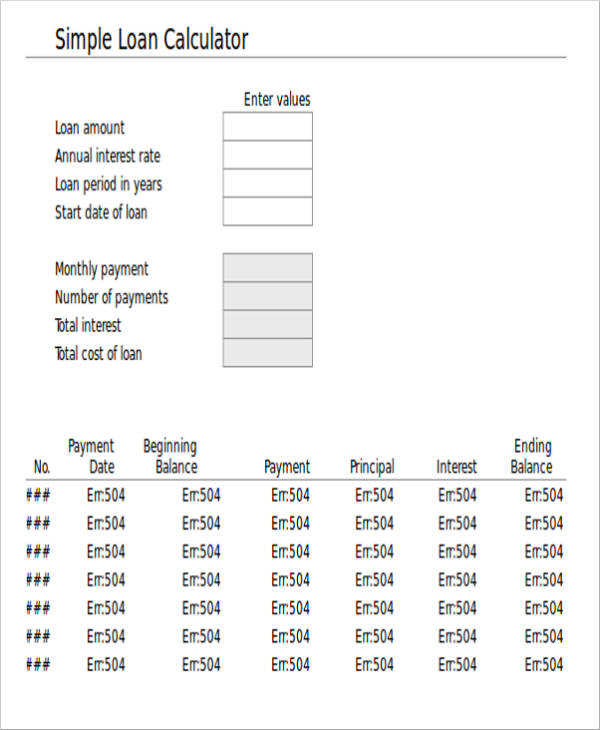

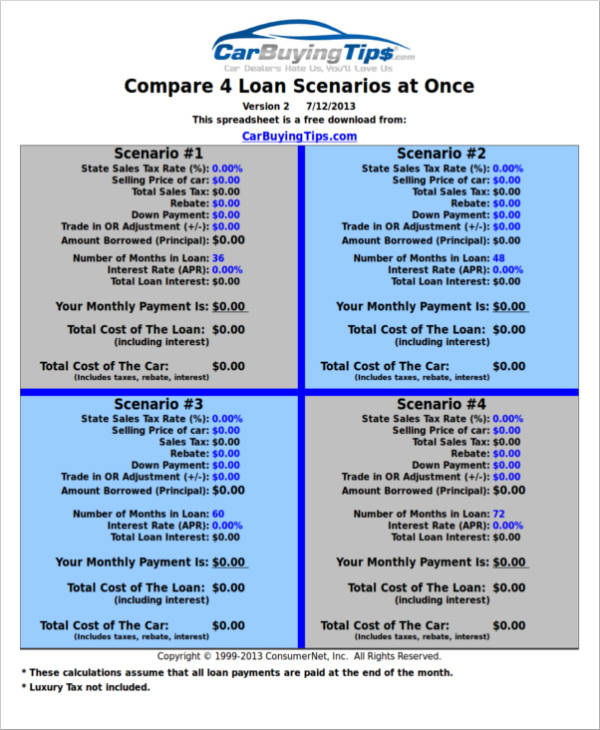

Free 9 Loan Spreadsheet Samples And Templates In Excel

Pin On Go Math 16 1 Grade 8 Answer Key

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

Free 9 Loan Spreadsheet Samples And Templates In Excel

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

Free 9 Loan Spreadsheet Samples And Templates In Excel

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Mortgage Underwriters Meaning Useful Factors Outcomes And More

Difference Between Lease And Finance Economics Lessons Accounting And Finance Accounting Basics

Free 9 Loan Spreadsheet Samples And Templates In Excel

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

Free 9 Loan Spreadsheet Samples And Templates In Excel

Here S An Overview Of The Education Loan Process Education Free Education Loan

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022